State of Idaho Payroll Calendar – Payment needs to be at least once a month. Standard pay periods should be assigned ahead of time by the company, and payment should be made not more than 15 days after completion of the pay duration. Payment should be made on a preceding workday if the routine payday falls on a nonwork day. If they follow a constant pattern of unfortunate payment of earnings to their workers, companies might deal with a civil charge per pay duration.

Salaries should be paid in cash money, by check, or by direct deposit. Companies that pay their staff members by check need to attend to check cashing, without charge, at a bank or somewhere else. Direct deposit. Companies might transfer staff members’ salaries straight into a bank or other banks, offered that the workers have actually willingly licensed the deposit. Staff members might withdraw this permission. Companies cannot need staff members to get their pay through direct deposit. Payroll cards. Idaho does not have a law specifically limiting a personal company from paying through a payroll card.

Idaho companies that pay incomes subject to federal withholding need to keep earnings tax from payments made in Idaho, despite where the payment is made. Workers covered by Idaho’s base pay law need to be paid $7.25 an hour. Companies need to pay tipped workers a minimum of $3.35 an hour. If incomes plus suggestions paid do not at least equivalent the minimum wage, companies should make up the distinction. Shared or pooled ideas cannot be applied to the base pay.

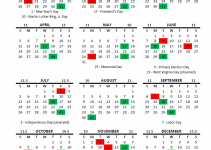

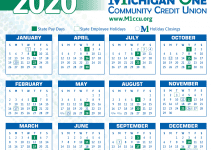

State of Idaho Payroll Calendar 2025

[su_button url=”https://www.sco.idaho.gov/Documents/Printable%20Version%202021%20Payroll%20Calendars/Payroll%20Calendar%20-%202021%20Paydays%20and%20Holidays.pdf” target=”blank” style=”soft” background=”#fdbe34″ color=”#0d226b” size=”5″ icon=”icon: download” icon_color=”#0d226b” rel=”nofollow” title=”click here to download manual”]Idaho State Payroll[/su_button]