Welcome to Hawaii, The sun’s out, the surf’s up, plus the lifestyle is lavish. That’s precisely why you began a small company in The Aloha State. Whether or not you manage a surf store in Honolulu or perhaps a bed & breakfast in Maui, there’s one particular thing that will not be laid back at all: payroll taxes.

Hawaii’s existing base pay is $10.10. Likewise, Hawaii companies should abide by federal base pay policies, which are determined by the federal base pay at $7.25. Hawaii needs companies to keep state earnings tax from the incomes of locals operating in other states, even if the other government needs to keep on the same earnings.

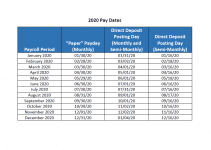

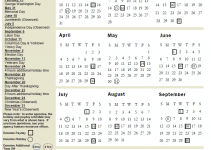

Hawaii Payroll Calendar for Employers

Companies covered by Hawaii’s wage payment required to pay incomes a minimum of two times in a calendar month and not more than seven days after the close of a pay period. Companies can pay salaries once a month if most staff members in a collective decide to choose a regular monthly payment.

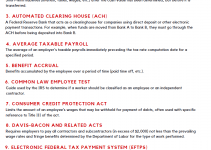

Hawaii Income Tax Withholding

Hawaii obliges companies to keep state earnings tax from their workers’ incomes and remit the quantities kept to the Department of Taxation. Every company with several workers in Hawaii needs to keep earnings tax from the incomes of both nonresident and resident staff members for services carried out in Hawaii. Locals might get a credit versus their Hawaii earnings tax for earnings taxes paid to another state.

State of Hawaii Payroll Calendar 2024

State of Hawaii Payroll Calendar 2024