State of Georgia Payroll Calendar – Most state and local governments have implemented payroll system that includes a state pay period calendar. The purpose of the state pay period calendar is to assist with recording, collecting, and providing pay period information to employees. This information is used for the employee’s benefits, disciplinary actions, and job security. State pay period calendar is usually a simple one page spread sheet. Workers covered by Georgia’s minimum wage law need to be paid $5.15 an hour. Workers covered within the Fair Labor Standards Act should get the federal base pay of $7.25 per hour.

Nonresidents undergo Georgia tax if they work in Georgia for beyond 23 days in a calendar quarter, earn more than 5% of their earnings in Georgia, or can associate more than $5,000 of their earnings to Georgia? That residents working out-of-state are exempt from Georgia income tax withholding in case their payment is subject to withholding in that state.

Georgia obligates employers, except those in the turpentine, sawmill, and farming industries, to pay all workers all salaries due on paydays picked by the employer, with paydays being divided between at least 2 (2) equivalent pay durations monthly. This policy does not be applicable to company authorities, superintendents, or other heads or subheads of departments who are paid a stipulated income. They might be paid month-to-month or yearly.

The State of Georgia pay period calendar can contain several different types of data. Payroll records, time cards, and income data are among the many types of data that a state pay period calendar can contain. The advantage of using this kind of calendar is that it is very easy to use and simple to implement.

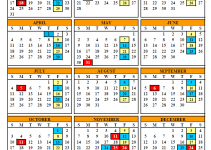

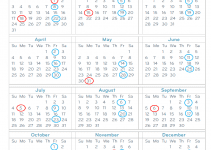

Download Georgia Payroll Calendar 2024

Georgia Payroll Calendar