2024 Per Diem Rates – When traveling on official business, per-diems are set amounts that can be spent for accommodation, meals, and other miscellaneous expenses. The General Services Administration (GSA) sets federal per diem rates, which are utilized by all federal employees and many private-sector employees who travel for their employers.

The amount of per-diem money you’ll get for meals, as well as lodging, is determined by where you’re going. A specific per-diem tariff has been established for nearly 400 destinations around the United States. The Fiscal Year 2024 general per diem prices is used for travel to any other part of the United States. The term per diem refers to a daily stipend for certain travel expenses for staff. It comes from the Latin word per diem, which means “by day.” Per diem rates exist for two distinct components:

Lodging

Meals and other incidentals

Federal agencies set these rates, and they apply to federal employees who travel for work. The Internal Revenue Service also uses them to determine if non-federal government employees owe tax on reimbursements for work-related expenses.

The 2019 tax returns, incidental expense (IE) consists only of tips and fees paid to baggage carriers, porters, hotel staff, and ship crew members. IE does not include travel expenses between lodging, business, dining, and other locations. These expenses for transportation and mail should be repaid separately.

Per diem expenses and employee driving expenses can also be treated separately. You can use either actual costs or the standard IRS mile rate of 57.5 cents per mile in 2020, decreasing to 56 cents per mi in 202 to account for driving expenses.

What are the Per Diem Rates?

The General Services Administration determines the per diem rates for every city and state in the continental (also called contiguous) United States (CONUS). Higher-cost areas have higher per diem rates, while in others, they vary depending on the time of the year. The cost of meals and hotels can vary from one city or another and from winter to spring.

The per diem rates are set by the Department of Defense (DOD), which applies to Alaska, Hawaii, U.S. territories, and possessions. This is known as OCONUS (outside of the contiguous United States). Per diem rates are set by the Department of State (DOS).

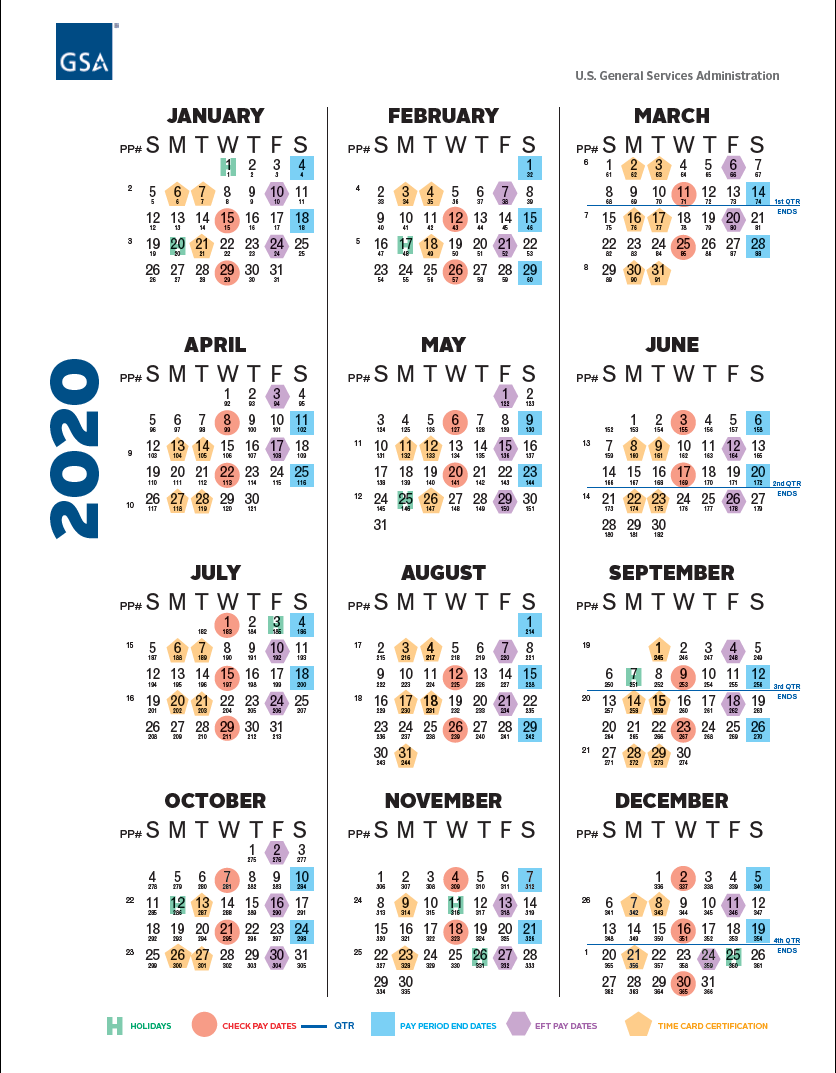

Each year, the per diem rates are updated on October 1st to match the start of the fiscal year for the United States government.

The per diem rate for lodging in CONUS destinations does not include taxes. The per-diem rate for meals & incidentals (M&IEs) is 75% of the full day amount.

State Per Diem Rates

| State | Number Per-Diem Destinations | Average Meals & Incidentals Rate | Average Lodging Rate |

| Alabama | 67 | $55.19 | $96.76 |

| Arizona | 16 | $58.81 | $108.72 |

| Arkansas | 75 | $55.08 | $96.09 |

| California | 59 | $62.86 | $131.44 |

| Colorado | 64 | $59.67 | $115.11 |

| Connecticut | 8 | $60.63 | $107.50 |

| Delaware | 3 | $57.33 | $115.78 |

| District Of Columbia | 1 | $76.00 | $220.17 |

| Florida | 67 | $58.06 | $112.04 |

| Georgia | 159 | $55.39 | $97.73 |

| Idaho | 44 | $56.00 | $98.44 |

| Illinois | 102 | $55.59 | $98.44 |

| Indiana | 92 | $55.17 | $96.98 |

| Iowa | 99 | $55.07 | $96.28 |

| Kansas | 105 | $55.37 | $96.84 |

| Kentucky | 120 | $55.24 | $97.00 |

| Louisiana | 64 | $56.45 | $97.82 |

| Maine | 16 | $58.44 | $107.82 |

| Maryland | 24 | $60.71 | $115.69 |

| Massachusetts | 16 | $66.25 | $154.82 |

| Michigan | 83 | $55.54 | $99.13 |

| Minnesota | 87 | $55.98 | $98.16 |

| Mississippi | 82 | $55.22 | $96.28 |

| Missouri | 115 | $55.67 | $98.11 |

| Montana | 56 | $55.63 | $98.97 |

| Nebraska | 93 | $55.06 | $96.15 |

| Nevada | 17 | $56.00 | $98.00 |

| New Hampshire | 10 | $61.20 | $116.81 |

| New Jersey | 21 | $59.71 | $120.21 |

| New Mexico | 33 | $56.03 | $101.16 |

| New York | 62 | $59.68 | $114.98 |

| North Carolina | 100 | $55.45 | $98.08 |

| North Dakota | 53 | $55.00 | $96.00 |

| Ohio | 88 | $55.77 | $99.16 |

| Oklahoma | 77 | $55.08 | $96.10 |

| Oregon | 36 | $56.58 | $102.33 |

| Pennsylvania | 68 | $56.40 | $100.84 |

| Rhode Island | 5 | $60.80 | $133.02 |

| South Carolina | 46 | $56.57 | $104.36 |

| South Dakota | 66 | $55.67 | $96.57 |

| Tennessee | 95 | $55.26 | $98.09 |

| Texas | 255 | $55.44 | $99.35 |

| Utah | 29 | $56.38 | $103.18 |

| Vermont | 14 | $61.07 | $106.08 |

| Virginia | 134 | $56.51 | $102.73 |

| Washington | 39 | $59.44 | $108.64 |

| West Virginia | 55 | $55.04 | $96.29 |

| Wisconsin | 72 | $55.51 | $97.39 |

| Wyoming | 23 | $57.78 | $107.80 |